Default Judgments, Foreclosures and worst… what does it all mean?

With the hikes in interest rates, many homeowners are feeling the pinch with bond instalments nearly doubling since the Covid years.

Now while it might be tempting to skip paying your bond instalments or the levies on your sectional titles home, one should avoid this temptation because banks and other mortgage bond service providers are foreclosing much earlier these days, than in the past. Homeowners’ associations and body corporates are also taking judgment against defaulting owners, often instructing the Sheriff to cut water and electricity services to sectional titles properties.

And with so many legal words now being part of our everyday conversations, what does it all mean? Here is a simple guide:

Section 129 Letter in terms of the National Credit Act: This letter is issued when a company who provided goods or services to you on credit wants you to bring the arrears up to date, failing which, they will institute legal proceedings against you.

Debt Review: The process where a debt councillor helps you to reduce your monthly debt instalments, usually by negotiating a longer repayment term with your creditors.

Summons: This is a legal document that is served by the Sheriff and it sets out the reasons why a matter is referred to court for adjudication by a Magistrate or a Judge. Always speak to an attorney when you receive a summons.

Administration: This is a legal option for consumers who have debts amounting to R50 000 or less. Repayments of debts are required at least every third month. Only the court can cancel the Administration order.

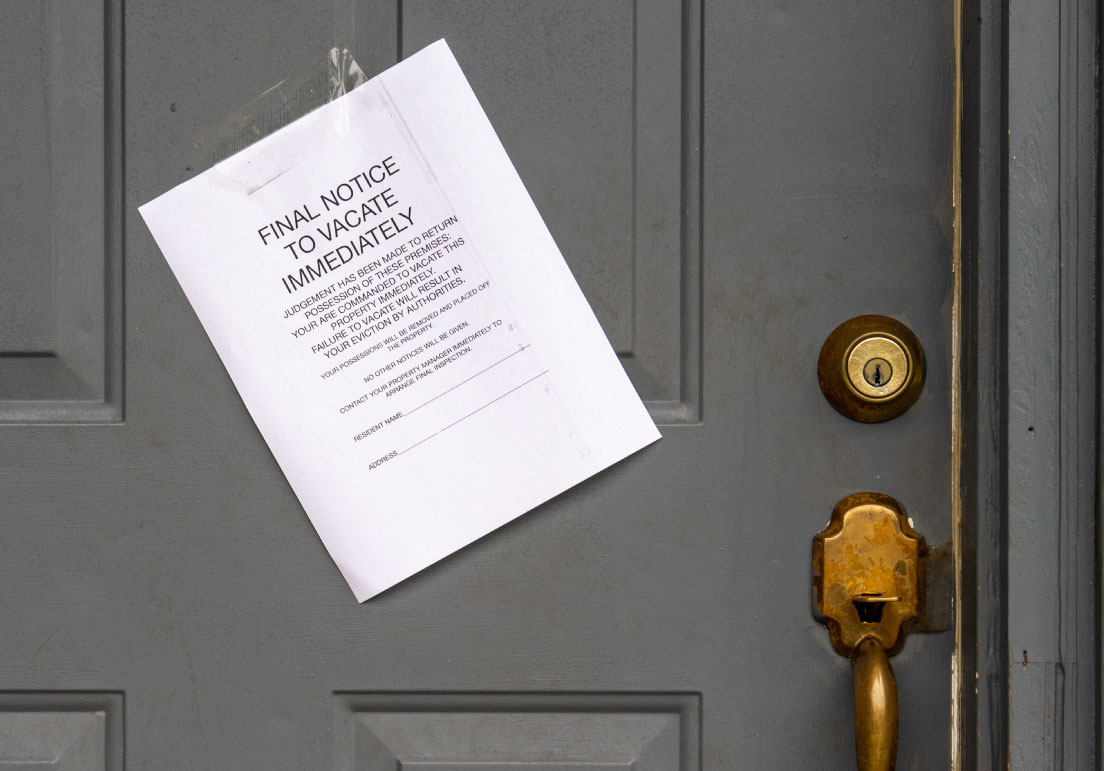

Default Judgment: This is an order by court, against a debtor, who did not defend himself in court when the creditor took the breach of contract and the resulting arrears, to court. It may ultimately result in you losing your home.

Foreclosure: This is when the bank repossesses your home because you didn’t pay your bond installments, as per the contract that you signed with the bank. The bank repossesses the house and will ultimately sell the house in execution.

Sale in Execution: This is when a home is auctioned off, to the highest bidder, to allow the financial service provider to recoup as much of its loan funds and the related legal expenses incurred.

Sequestration: When the debtor is taken to court for debts and the court issues an order resulting in all your property being sold, to repay your debts.

Rehabilitation: This is achieved when the debt is paid off or reduced through debt review, administration, sequestration or court processes.

Debt administration orders, default judgments, judgments, sequestrations and even rehabilitation orders are recorded as part of your credit history. It may remain against your name for 5 to 10 years. This negative rating may affect your ability to obtain credit, rent a car or rent a home or buy property. In the case of sequestration, it may even impact your ability to travel, enter into contracts and your ability to work.

It is therefore important to seek financial and legal advice, if you are falling behind with the monthly debt commitments.

It is advisable to consult the attorneys in Johannesburg and Cape Town of Julies Attorneys Inc. for legal advice on the specific circumstances of your matter.

Disclaimer: The information provided on this website are for general informational purposes only and does not constitute legal advice. No reader, user, or browser of this site should act or refrain from acting on the basis of information on this site without first seeking legal advice from an attorney. Only your individual attorney can provide assurances that the information contained is applicable to your particular situation. The views expressed are those of the individual authors writing in their individual capacities only. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.